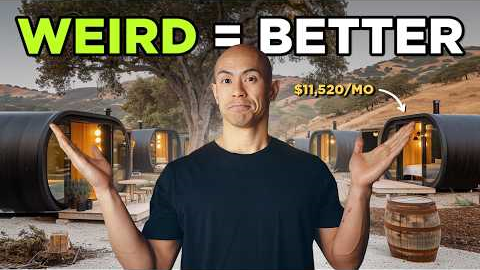

Weird Rentals Are Taking Over (Here's Why and How to Find Yours)

904 View

Share this Video

- Publish Date:

- January 12, 2026

- Category:

- AirBnB Investing

- Video License

- Standard License

- Imported From:

- Youtube

Tags

Most real estate investors follow the same path: buy more traditional rentals and play it safe. I did the opposite. In this video, I break down why 1 weird rental can outperform 10 traditional rentals—using real numbers from unique Airbnbs and unconventional short-term rentals. You’ll learn:

• Why traditional rentals are facing increasing competition

• How weird and unique Airbnbs win on pricing power and demand

• The hidden costs of scaling multiple long-term or short-term rentals

• When investing in a weird space makes sense—and when it doesn’t

This video is for investors interested in short-term rental investing, unique Airbnb properties, and unconventional real estate strategies that prioritize ROI over door count. If you’re deciding between scaling traditional rentals or building something truly differentiated, this breakdown will help you think more strategically.

LEARN MORE WITH ME FOR FREE:

👉🏼 Let My Team Find Your Next Property: https://shorturl.at/mH1Vv

👉🏼 Join our free community to chat with me: https://bit.ly/Kai_FreeCommunity

WORK WITH MY PRO SERVICES & PARTNERS:

👉🏼 Professional Tax Strategy & Accounting: https://shorturl.at/vrgvS

👉🏼 Airdna License Discount: https://invite.airdna.co/kaiandrew

👉🏼 Custom Cost Seg Report: https://calendly.com/d/cs9x-fsm-dmz/accountability-cost-segregation-study-kai-andrew

----------------------------------------------------

Connect with me:

📷 Instagram: @KaiJAndrew

Website: https://kaiandrew.com

----------------------------------------------------