DIVIDEND GROWTH STOCKS ARE TANKING (I'm Buying)

865 View

Share this Video

- Publish Date:

- October 3, 2023

- Category:

- Appreciation Investing

- Video License

- Standard License

- Imported From:

- Youtube

Tags

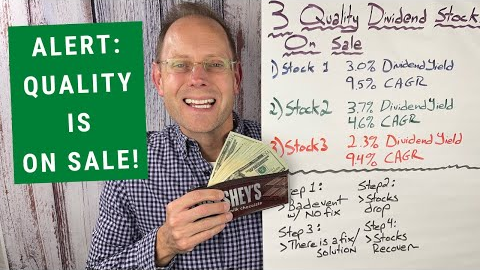

Quality dividend stocks are tanking right now! I'm excited to cover three premium dividend growth stocks that are on sale, ones I plan to purchase in the coming weeks.

#dividend #stock #investing

Timestamps:

0:00 INTRODUCTION: The blue chip, core, quality dividend stocks are correcting.

0:23 I will cover three household brand name stocks in the video today, including The Hershey Company (HSY), PepsiCo (PEP), and Clorox (CLX).

0:48 SEGMENT 1: THE FOUR STAGES OF STOCK MARKET INVESTING ILLUSTRATION

1:20 STAGE 1: A terrible situation will present itself. The situation will seem to have no solution. (Right now: Out of control inflation.)

3:00 STAGE 2: The stock market corrects. (This is where we are at right now.)

3:15 Even core stocks are correcting. It's not only ancillary stocks.

3:29 RTX, O, and GIS (covered in my last video) are all correcting. These are all quality positions.

4:10 IMPORTANT: The average investor sells during this phase of the market cycle. Personally, I feel this is a great time to buy.

4:50 STAGE 3: A solution is found. (The problem is gone.)

5:05 Example: Stocks were crashing during the pandemic. However, a solution came, and stocks recovered. The problem was gone!

6:24 STAGE 4: The stock market recovers. Stocks surge to new heights!

7:20 IMPORTANT: The average investors buys aggressively. Personally, I feel this is a great time to hold and stockpile cash for a future correction.

8:20 KEY: As dividend stocks go down, my money deployed can buy me more future cash flow.

8:44 SEGMENT 2: THREE QUALITY CPG STOCKS ON SALE (PEP, CLX, and HSY)

9:05 Clorox (CLX) Dividend Stock: This stock followed its own cycle. Business fundamentals have now recovered.

10:17 It was difficult to own CLX. They were losing money for a while!

10:41 Keeping the faith when times are bad.

11:53 IMPORTANT: Being off a 52-week high does not create value. I look if a stock is off the 52-week high to pinpoint possible stocks to investigate.

13:04 Forward PEs are looking great, relatively speaking.

13:32 PE is relative to the quality of the stock (and the category).

14:05 Dividend Yields are Strong: It's rare to see PEP dividend over 3.0%.

14:42 Dividend CAGR analysis: I especially like HSY dividend growth rate.

15:21 Dividend Yield-on-Cost Analysis

15:55 SEGMENT 3: QUALIFIED DIVIDENDS VS. TREASURY BOND ANALYSIS

16:10 Treasury Yields: 5% range

16:35 There is a real tradeoff these days (stocks vs. bonds)

18:45 Is it worth investing in dividend stocks anymore? (Given high Treasury yields.)

19:05 SEGMENT 4: DIVIDEND YIELD-ON-COST PROJECTIONS

19:20 Treasury bonds have a maturity date, dividend stock yield-on-cost can last forever (and keep growing).

20:23 What I like about these stocks.

10:27 What I don't like about these stocks.

21:27 SEGMENT 5: CLOSING THOUGHTS FOR TODAY

22:45 DISCLOSURE AND DISCLAIMER

DISCLOSURE: I am long PepsiCo (PEP), Clorox (CLX), Starbucks (SBUX), Raytheon Technologies (RTX), Realty Income (O), General Mills (GIS), and SCHD. I own these stocks in my personal dividend stock portfolio. I’m also long Treasuries. My kids are long Hershey Company (HSY).

DISCLAIMER: All information and data on my YouTube Channel, blog, email newsletters, white papers, Excel files, and other materials is solely for informational purposes. I make no representations as to the accuracy, completeness, suitability or validity of any information. I will not be liable for any errors, omissions, losses, injuries or damages arising from its display or use. All information is provided AS IS with no warranties, and confers no rights. I will not be responsible for the accuracy of material that is linked on this site.

Because the information herein is based on my personal opinion and experience, it should not be considered professional financial investment advice or tax advice. The ideas and strategies that I provide should never be used without first assessing your own personal/financial situation, or without consulting a financial and/or tax professional. My thoughts and opinions may also change from time to time as I acquire more knowledge. These are, as discussed above, solely my thoughts and opinions. I reserve the right to delete any comments for any reason (abusive in nature, contain profanity, etc.). Your continued reading/use of my YouTube Channel, blog, email newsletters, whitepapers, Excel files, and other materials constitutes your agreement with and acceptance of this disclaimer.

COPYRIGHT: All PPC Ian videos, Excel files, guides, and other content are (c) Copyright IJL Productions LLC. PPC Ian is a registered trademark (tm) of IJL Productions LLC.