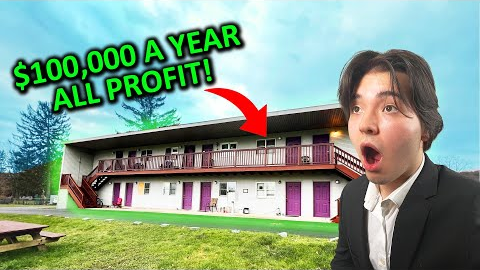

How This CHEAP Property Makes $100,000 a YEAR

12 View

Share this Video

- Publish Date:

- March 8, 2023

- Category:

- Appreciation Investing

- Video License

- Standard License

- Imported From:

- Youtube

Tags

🔴 Schedule a Meeting With Me:

https://calendly.com/josephkhateri/45min

🔴 Dealcheck App (Affiliate Link):

https://dealcheck.io?fp_ref=joseph81

🔴 My Equipment I Use to Record:

http://bit.ly/3G1rjE8

--------------------------------SOCIAL--------------------------------

👥 Tiktok: https://bit.ly/3ThLhQg

📷 Instagram: https://bit.ly/3wpEwTm

👍 Facebook: http://bit.ly/3XifG3y

📚 LinkedIn: https://bit.ly/3Vl2ji0

📹 VR YouTube: https://bit.ly/3ruDxxr

Property Overview

First things first, let's take a look at the property itself. This huge rental complex is located in Williamsport PA, a town that I actually lived in for a while, and it's a massive 12 unit. There is a large need for 1-bedroom units in the area and especially at this price point. It boasts 12 1-bedroom units. This property was just sold but as a realtor I can help you find the next best thing in your area. Each unit would rent for about $700 a month, and I would personally know since I lived there.

Rent Roll

To use DealCheck, you simply put in the address of the property and some basic information such as the loan terms. Everything else is calculated for you, including the rental income and expenses. This tool is incredibly user-friendly and helps me make informed investment decisions.

So let's get back to the rental income. If you rent each unit for $700 a month, and you have 12 units, that's a whopping $8,400 a month or $100,800 a year! This is an incredible return on investment and goes to show just how profitable investment properties can be.

Of course, the expenses play a huge role in determining the profitability of the property. That's why I'm going to delve into the expenses in a little more detail later in the video.

Price and Loan

Now that we've talked about the rental income, let's talk about the price of this property. You're probably wondering how much this property cost, and I have to say, it was a steal at $399,900 when it was listed. I came across this property while I was looking at it for a client, and they were considering buying it with cash. As a result, there wasn't any financing involved in this case.

But don't worry if you don't have that kind of cash on hand. As a realtor, I know some fantastic lenders that could help you get a commercial loan to make this property yours. Based on averages, you should be able to finance it with a loan at a 6% interest rate in Williamsport, with a 30-year fixed rate repayment period.

The monthly payments come out to $1,918 a month, but trust me, the rental income more than covers it. With the $8,400 a month in rental income, you're looking at a substantial return on investment. So, if you're interested in buying this property or any other investment properties, I can connect you with lenders that can help you get the financing you need.

Expenses

First, let's take a look at the gross rent. We estimated that the rental income would be $100,800 a year, based on the $700 a month rental rate for each of the 12 units. But, to be realistic, we have to factor in a 5% vacancy rate for potential empty units.

Next, let's add up the other expenses. We have $7,000 in property taxes, $2,000 in insurance, $9,500 in property management (which is roughly 10% of the rent), $10,000 in maintenance, and $5,000 in capital expenditures. All these expenses amount to a total of $33,524 in operating expenses.

In addition to operating expenses, we also have to consider loan payments. Based on the loan terms we discussed earlier, the monthly loan payments come out to $1,918 a month, or $23,017 a year.

With all these expenses taken into account, we are left with a cash flow of $39,219 per year. If you choose not to use a loan, then the cash flow after all expenses is actually $62,236 per year.

Cons

First up, the cost of the property and the financing. The price tag for this property was $399,900, which might seem steep for some, especially if you're looking to buy with cash. But, for those who are looking for financing, a commercial loan is your best bet.

Now, the second con is the potential appreciation of the property or the lack thereof. It's important to do your research before investing in any real estate property, especially if you're counting on appreciation to increase the value of your investment. In this case, the town the property is located in has seen a slight decline in population over the past 40 years, which is something you should consider when making your decision. As a realtor, I can't advise you against buying in a certain area, but it's crucial to weigh the pros and cons and determine if this investment aligns with your goals and expectations.

🕘Timestamps:

0:00 - Property Overview

1:42 - Renting

3:57 - Price/Loan

5:08 - Plug

6:07 - Expenses

9:13 - Cons

11:51 - Outro

🎬Watch My Most Recent Videos:

http://bit.ly/3tRMqmx

#rentalproperty #multifamily #realestateagent