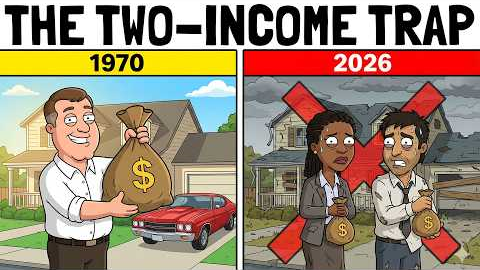

Why Two Incomes Leave You Broker Than One (The Two-Income Trap Explained)

1,028 View

Share this Video

- Publish Date:

- December 31, 2025

- Category:

- Fractional Real Estate

- Video License

- Standard License

- Imported From:

- Youtube

Tags

Why Two Incomes Leave You Broker Than One (The Two-Income Trap Explained)

Why do so many Two Incomes Traps households making over $100,000 still feel broke?

Why does a couple doing “everything right” — good jobs, degrees, marriage, home ownership — feel financially fragile instead of secure?

In this video, we break down the Two-Income Trap, a concept first identified by Elizabeth Warren, and explain why two working adults often end up worse off than single-income families from 50 years ago.

You’ll learn:

- Why six-figure households still live paycheck to paycheck

- How housing, childcare, healthcare, and education absorbed the second income

- Why dual-income families have less financial flexibility, not more

- How banks and housing markets quietly redefined “affordable”

- Why earning more doesn’t fix a system designed to consume every dollar

- The one-income foundation strategy that restores margin and resilience

- This isn’t about blaming families or personal finance mistakes.

- This is about understanding a systemic trap — and learning how to escape it.

📊 Subscribe for weekly financial education that challenges how you think about money.

#TwoIncomeTrap #PersonalFinance #FinancialIndependence

Disclaimer:

This content is for educational purposes only and is not financial advice. Individual results vary. Please consult a qualified professional for guidance specific to your situation.